The original proponents of the 401(k) plan, which has become the dominant source of retirement savings for most Americans, are rueful about the revolution they unintentionally began.

"[Many early backers of the 401(k)] say it wasn't designed to be a primary retirement tool and acknowledge they used forecasts that were too optimistic to sell the plan in its early days," The Wall Street Journal reports. "Others say the proliferation of 401(k) plans has exposed workers to big drops in the stock market and high fees from Wall Street money managers."

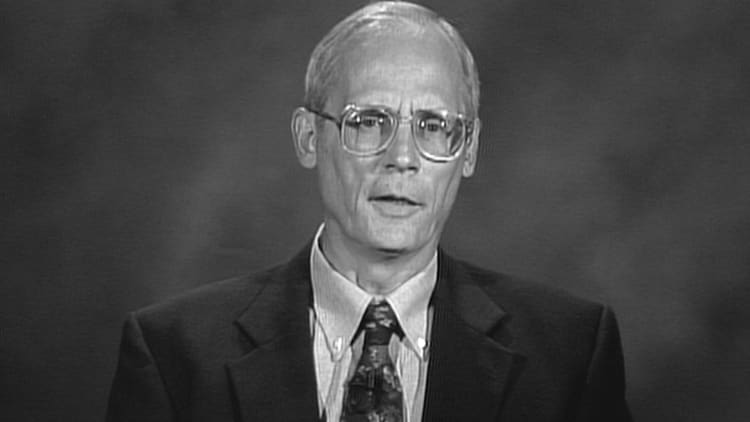

Even the "father of the 401(k)," Ted Benna, tells The Journal with some regret that he "helped open the door for Wall Street to make even more money than they were already making."

Other experts agree: On its blog, the Economic Policy Institute recently declared 401(k)s "a poor substitute" for the defined benefit pension plans many workers primarily relied on, which provide a fixed payout for employees at retirement, and which have now become increasingly rare. Nowadays, "just 13% of all private-sector workers have a traditional pension, compared with 38% in 1979," reports The Journal.

That's despite the fact that 401(k)s are far less safe: "Unlike defined-benefit pensions, which provide set payouts for life, 401(k) accounts rise and fall with financial markets."

The accidental retirement revolution began in 1978, when Congress decided to alter the tax code with the Revenue Act.

1978: Congress passed the Revenue Act of 1978, including a provision — Section 401(k) — that gave employees a tax-free way to defer compensation from bonuses or stock options. The law went into effect on January 1, 1980.

Ted Benna, a benefits consultant at the Johnson Companies, saw the law as an opportunity for employers to create a tax-advantaged savings account for their employees.

"I knew it was going to be big, but I was certainly not anticipating that it would be the primary way people would be accumulating money for retirement 30 plus years later," Benna now tells Workforce.

1981: The IRS issued rules that allowed employees to contribute to their 401(k) plans through salary deductions, which jump-started the widespread roll-out of 401(k) plans in the early 1980s.

1983: Nearly half of all large firms offered, or considered offering, a 401(k) plan. Companies liked the option because it was cheaper and more predictable to fund than pensions. Employees were attracted to a new savings vehicle that, they were told, could put them in a better position to retire.

"Two bull-market runs in the 1980s and 1990s pushed 401(k) accounts higher," The Journal reports. Then, "two recessions in the 2000s erased those gains and prompted second thoughts from some early 401(k) champions."

1990: 401(k) plans held more than $384 billion in assets, with 19 million active participants.

1996: Assets in 401(k) plans exceeded $1 trillion, with more than 30 million active participants.

2001: The Economic Growth and Tax Relief Reconciliation Act resulted in several changes to the 401(k). In general, the law increased the amount that individuals and companies could contribute to the accounts. Additionally, it allowed participants over the age of 50 to make "catch-up" contributions. In 2017, the contribution limit is $18,000 and the max catch-up contribution is $6,000.

2006: The Pension Protection Act made it easier for companies to enroll their employees automatically in 401(k) plans. Some companies even automatically increased their employee's contributions by 1% a year to encourage saving.

Today: 401(k) plans hold more than $4.8 trillion in assets. And pensions, in the private sector, are increasingly rare.

"The great lie is that the 401(k) was capable of replacing the old system of pensions," former American Society of Pension Actuaries head Gerald Facciani tells The Journal. "It was oversold."

Still, while some early proponents of the 401(k) plan are having second thoughts, there's no denying that "401(k)s have experienced tremendous growth, and workers are putting more money in today than ever before," according to Sarah Holden, senior director of retirement and investor research at ICI, who spoke to The Journal. "[These plans] established themselves as a successful component of America's retirement savings system."

Regardless, they're not going anywhere.