September was a horrible month for stocks. The Dow fell nearly 9%, its worst monthly drop since March 2020, when pandemic lockdowns started in the United States. The index ended Friday deeply in the red, too.

The Dow, a widely watched barometer of America’s stock market that includes corporate giants such as Apple (AAPL), Coca-Cola (KO), Disney (DIS), Microsoft (MSFT) and Walmart (WMT), was down about 500 points, or 1.7%. All 30 Dow stocks ended the day lower.

Worries about rising inventory levels at Dow component Nike (NKE) pushed the blue chips lower Friday. Shares of Nike (NKE) plunged 13% as investors worried about how it will need to heavily discount sneakers and other athletic apparel.

The Dow fell more than 5% in the third quarter and is now down about 20% this year, putting it in a bear market. The Dow is trading near its lowest levels since November 2020.

The S&P 500, which fell 1.5% Friday, is down nearly 9% in September and has fallen nearly 24% in 2022. That puts the index on track for its worst annual drop since 2008. The tech-heavy Nasdaq Composite also dropped 1.5% Friday and it has plunged almost 10% this month. It is down more than 30% this year.

Some market experts are hopeful that the worst could soon be over for stocks, given how sharp the sell-off has been. But investors remain nervous about the economy and earnings.

Inflation has led the Federal Reserve to drastically raise interest rates. That could eventually slow consumer and business spending. Worries about a recession are growing.

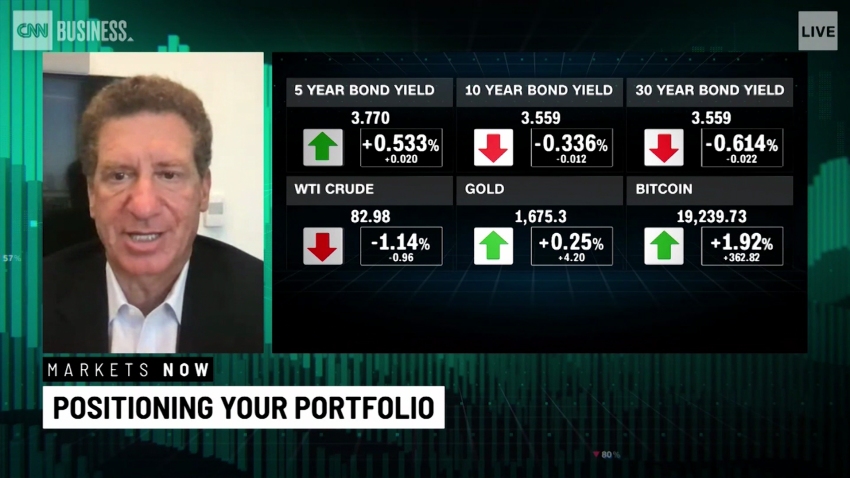

The CNN Business Fear & Greed Index, which measures seven indicators of Wall Street sentiment, is showing levels of Extreme Fear. And there have been no safe havens for investors to ride out the market storm. Bonds, gold and bitcoin have all plunged in 2022 as well.