The US government is barreling towards the day it can no longer pay its bills unless Congress passes legislation raising the debt ceiling. However, that so-called X-date may be on an accelerated timeline for some unlikely reasons.

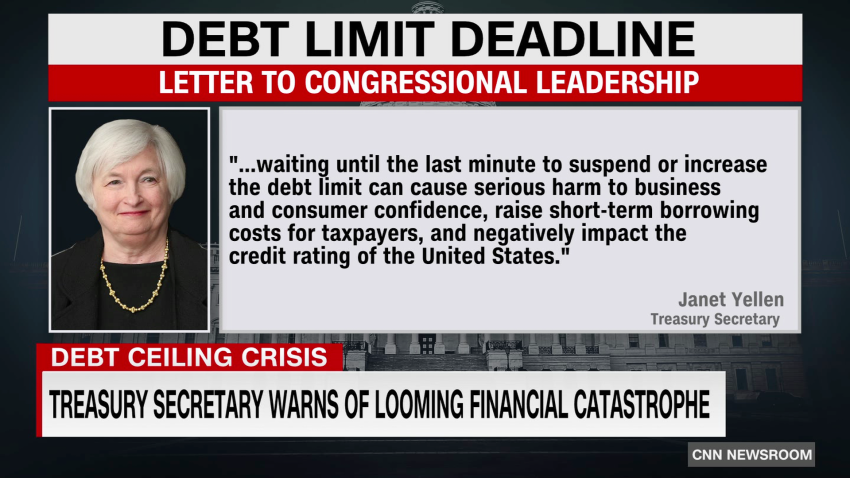

Earlier this year, the Congressional Budget Office estimated that the X-date would come between July and September, but in a letter to House Speaker Kevin McCarthy this month, Treasury Secretary Janet Yellen wrote that “after reviewing recent federal tax receipts, our best estimate is that we will be unable to continue to satisfy all of the government’s obligations by early June, and potentially as early as June 1.” She reiterated that same timeline this week.

While the Treasury Department hasn’t explicitly given a reason for its tax revenue deficiency, experts have said two main factors may have caused a shortfall.

Falling stock and crypto prices may have taken a toll

Capital gains taxes, which is money owed on profits from the sale of investments, were a significant piece of the tax puzzle that fell short this year, according to Michael Pugliese, a senior economist at Wells Fargo.

Pugliese said that last year, capital gains taxes paid to the government were “unusually strong” due to a market boom.

“Stock prices were up quite a bit, the crypto boom, all those different things. That led to really strong capital gains tax revenue increases,” he said.

However, stocks and other assets like cryptocurrencies and the housing market saw sinking valuations over the past year.

“I think most forecasters expected a dropoff this year,” Pugliese said. However, he said revenue from capital gains taxes came in even weaker than most experts anticipated.

“What matters is that they didn’t come in strong enough to ensure we could get to the end of July or the beginning of August, which was the hope,” he added.

Tornadoes, winter storms and mudslides pushed deadlines for millions of taxpayers

Another factor that may have lowered the federal government’s tax income this year: unexpected natural disasters.

Counties in multiple states, including Tennessee, Alabama and Georgia, were granted a deferral on tax payments due to severe storms and other natural disasters. Most recently, the IRS extended the deadline to pay taxes for California residents to October 16 due to severe winter storms, flooding and mudslides that occurred late last year and early this year.

California’s payments might have had an outsized effect on the federal government’s tax revenue shortage, said Mark Zandi, chief economist at Moody’s Analytics.

“California is one of the biggest states, with a lot of wealthy people, and that’s really undermined tax revenues that are coming in,” he told CNN.

Zandi added that the capital gains shortfall and tax payment deferrals were a “real surprise” to the US government and likely contributed to the default date getting moved earlier.

“Of course, there’s no way to predict it. That was a natural disaster coming out of nowhere, and the US could not have predicted it.”